How The Wrong Employee Benefit Strategy Could Cost Manufacturers 6x in a Merger or Acquisition

As the CFO of a manufacturing firm, we don’t have to tell you that companies are buying and selling their businesses based on a multiple of EBITDA,...

2 min read

Robert Gearhart

:

Updated on April 16, 2024

Here’s a familiar conversation. A manufacturer says, "We need to keep our costs down." Their broker responds, "No problem, we can do that. Let's bring in a high-deductible plan." DCW Group knows that is not a health insurance strategy. It’s a cheap parlor trick.

Putting in a Health Savings Account alongside a PPO may reduce an employer’s costs in the short term, as premiums are cheaper when the plan doesn’t cover as much, but every year those costs will keep going up. Instituting a high-deductible plan is a one-year bandage, not a sustainable health insurance strategy. Rather than continuing to increase your employees’ contribution, it's time for your manufacturing firm to change your approach to rising health insurance premiums.

Stop looking at which carrier is offering the lowest premium. Anyone can lower a premium. Just offer a worse benefit and charge more for it. Ultimately, chasing the lowest acquisition cost is not the right health insurance strategy.

Health care consulting firm and independent actuary, Milliman, has studied how employers spend money under any form of benefit plan. What they found was, 20% of the plan cost is a fixed expense, such as plan administration fees or stop loss premiums. The other 80% of plan cost is variable. It changes depending on what services your employees are getting, where those services are being performed, and what kind of claims you are amassing. By managing the supply chain, the 80% of variable plan costs within employers’ control, DCW Group can reduce the health plan cost.

Manufacturers don't have to offer less benefits. In fact, the only way to do reduce cost is to offer a better benefit, and offering a better plan starts with giving the employees an incentive to make the right decisions.

Insurance carriers will say their biggest value-add is their network discount. This is one of the biggest lies ever sold to the American public. In health care, there are four numbers, two of them are fake and two of them are real:

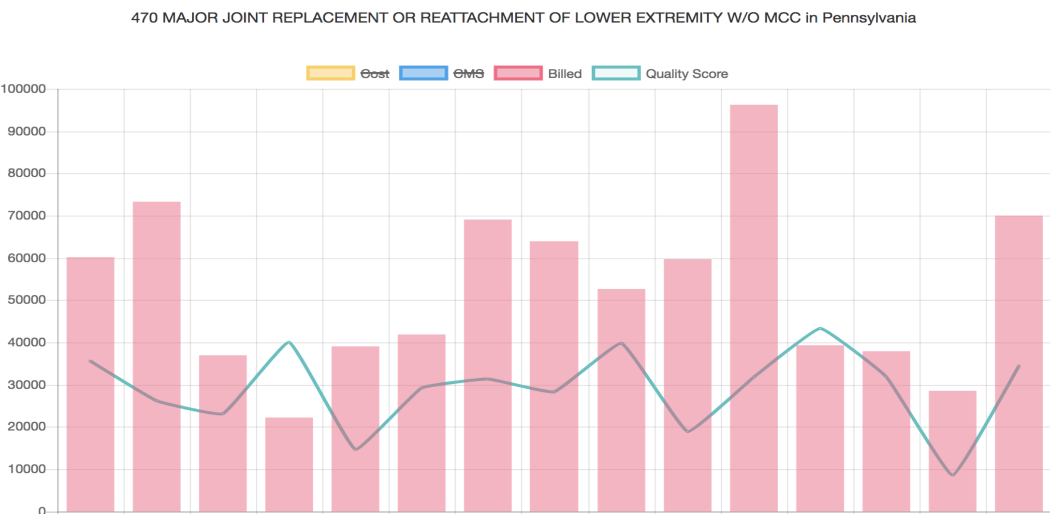

Providers have to bill Medicare the same way that they bill your private insurance. Diagnostic codes represent procedures, such as a major joint replacement, and the providers use those codes to bill insurance companies. Medicare also requires providers to submit their data on complications, infections, re-admission, length of stay, etc., which are then aggregated into a quality score that is put together by the Centers for Medicare and Medicaid Services.

Using real Medicare data from Pittsburgh, PA, as an example, one hospital bills $22,000 for a joint replacement procedure. Another bills $97,000 for the same procedure. Although the first hospital has the highest quality score from CMS, most patients go to the more expensive, brand name facility.

Even within the same health system, meaning hospitals that are owned by the same parent company, charges can vary by tens of thousands of dollars. It’s for a variety of reasons, such as building a new facility at one location where they need to offset that capital expense, but the reality is it’s all made up. If it wasn't, it would be standardized.

Even a network discount of 90% is irrelevant if the provider can simply bill more for the services. If insurance carriers are negotiating better and better discounts each year, hospitals should be making less profit, right? This is why relying on the network discount is not an effective health insurance strategy. It’s taking a fake discount off of a fake number.

As the CFO of a manufacturing firm, we don’t have to tell you that companies are buying and selling their businesses based on a multiple of EBITDA,...

Do you recommend price be the sole consideration for the products you manufacture? Probably not. So why do you shop for your company's health...

Manufacturers get healthcare benefits! The National Association of Manufacturers reports that 98% of its members provide healthcare plans for their...