A Health Insurance Strategy of Charging Your Employees More is Not a Strategy

Here’s a familiar conversation. A manufacturer says, "We need to keep our costs down." Their broker responds, "No problem, we can do that. Let's...

2 min read

Robert Gearhart

:

Jan 28, 2020 9:00:00 AM

Manufacturing firms want to know, "why are our health insurance rates continuing to increase year after year?"

It’s simple. You're trusting the other organizations to manage the health care supply chain, and they have no incentive to reduce insurance costs. Whether your health plan is fully insured or self-funded, you're allocating a specific dollar amount or premium to pay out claims. As long as the insurance carrier charges enough premium to meet their targets, what business incentives do they have to reduce your claims cost?

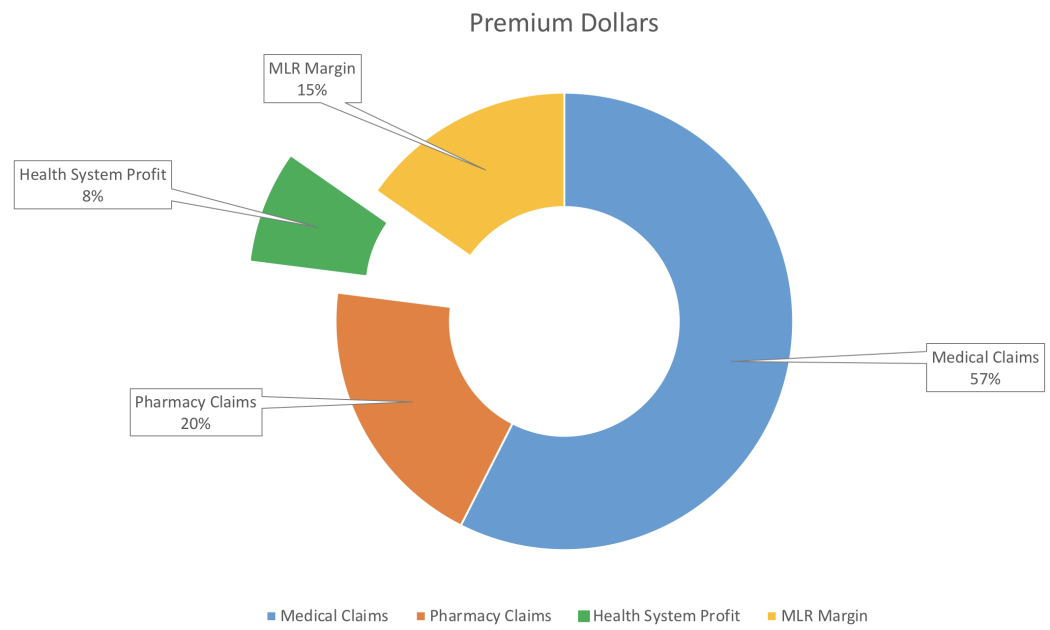

The Affordable Care Act (ACA), also known as Obamacare, almost guarantees that fully insured premiums will increase. The Medical Loss Ratio (MLR), established by the ACA, requires insurance carriers to pay 80% to 85% of all fully insured premium dollars (depending on group size) to claims and activities that improve the quality of care. If the insurance carrier pays out less than required in a given market segment, they have to reimburse employers the difference. All the insurance carriers want to do is make their profit margin and not lose money.

You, as the employer, are the one left to figure out how to do something different to stop the annual 5%, 10%, 15% rate increases.

Here’s a real-life example of why incentives are not aligned with a manufacturer’s desire to reverse the ever rising trend of health care costs.

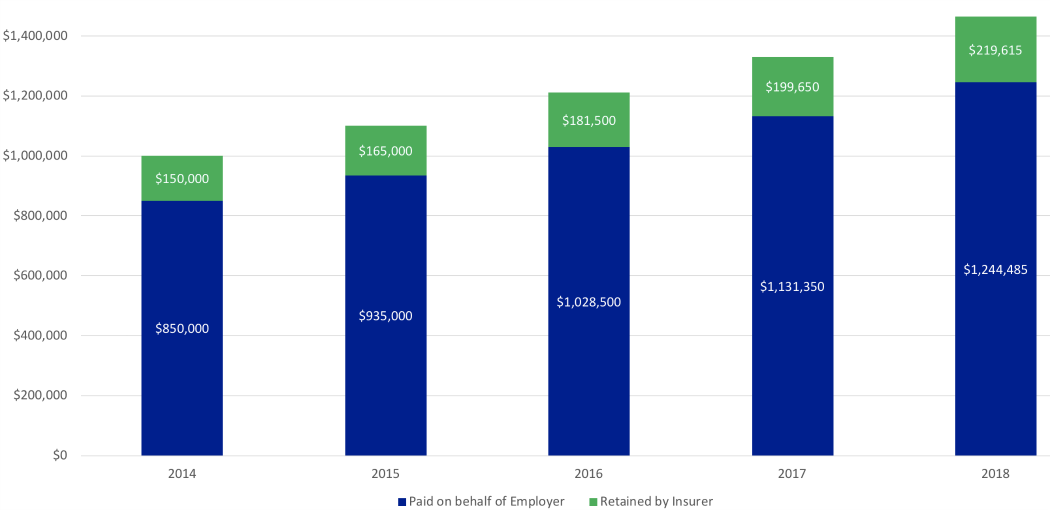

At the end of March 2018, a major health insurance carrier announced in its annual earnings statement for an East Coast market that the company increased revenue over expenses by $1 billion over the prior year. The carrier said it was driven by “the continued strengthened performance in their commercial and government segments.”

This is industry speak for the employer-sponsored market. This large national carrier also bought a local hospital system, saying consumers are benefiting from “increased access to high quality community-based health care.” Maybe. But think about it. If your insurance carrier buys a hospital and your employee calls that insurance company asking where they should go for a medical procedure, where do you think they’re going to send them? Their own hospital.

It is no different than if a business owner buys a warehouse and then their manufacturing firm leases it. They were going to pay rent, anyway. They might as well pay it to a company they own. That's exactly what these insurance companies are doing. And that's how they're generating high returns for shareholders and massive increases to their share prices.

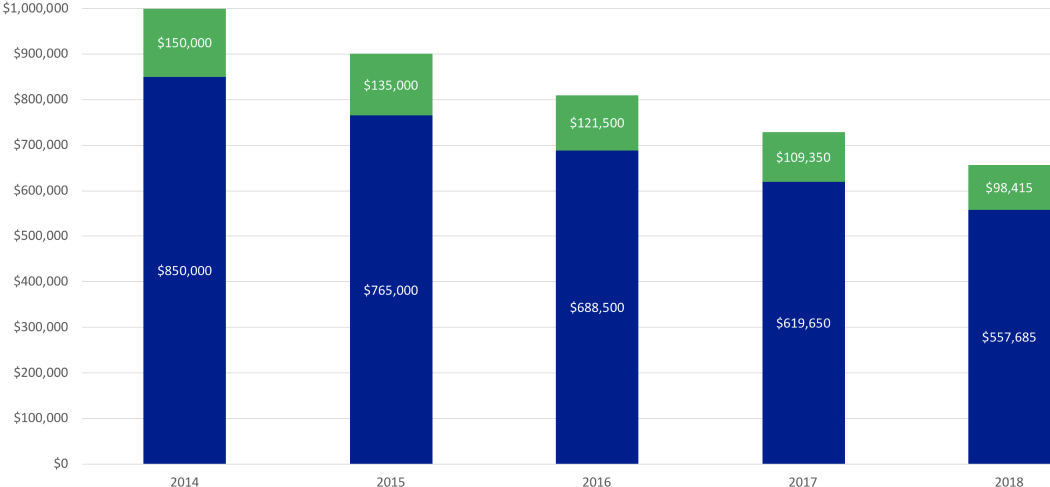

If insurance carriers reduce your fully insured premium, they're going to cause margin compression on their own business. No CEO of a publicly traded company could survive long producing the returns in the chart below.

Conversely, a rate increase actually gives the insurance carrier more margin to work with. As premiums go up, so does the amount the insurance company gets to run their business and offset administrative overhead.

If 80% of your health insurance cost is variable, and therefore controllable, you need to manage the health care supply chain to the your benefit. You have decades of rate increases to show what happens when supply chain management is left to outside third parties.

Here’s a familiar conversation. A manufacturer says, "We need to keep our costs down." Their broker responds, "No problem, we can do that. Let's...

Here’s a hard truth for most manufacturing firms. You’re not managing the supply chain when it comes to your employees’ benefits, which means you’re...

Specifically, does the broker fee agreement align with the success of your health insurance offering, and help you hold your costs down while...