Learn What Manufacturers Spend on Medical Insurance Benefits. Are You Competitive?

A Look at the Numbers – National versus Regional Costs – How Do You Stack Up? In the war for talent it is important to understand what hourly wages...

1 min read

Robert Gearhart

:

Jan 21, 2020 9:00:00 AM

We get asked this question all the time: “What’s everyone else doing?”

Manufacturers want to know, how do we stack up in a difficult labor market competing for qualified workers? Are our benefits good enough? Are we paying the right percentage of the premium?

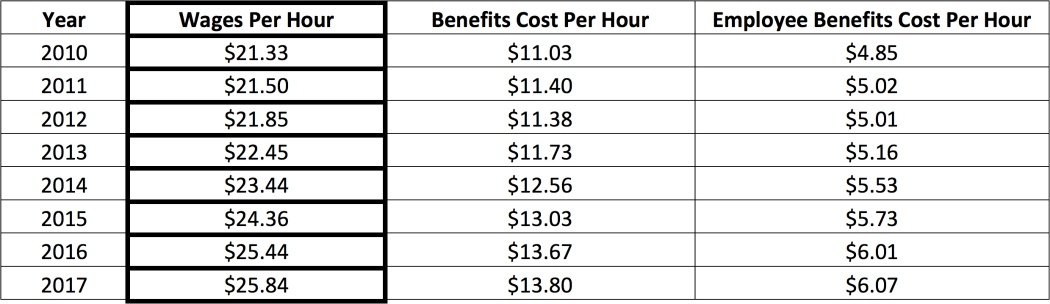

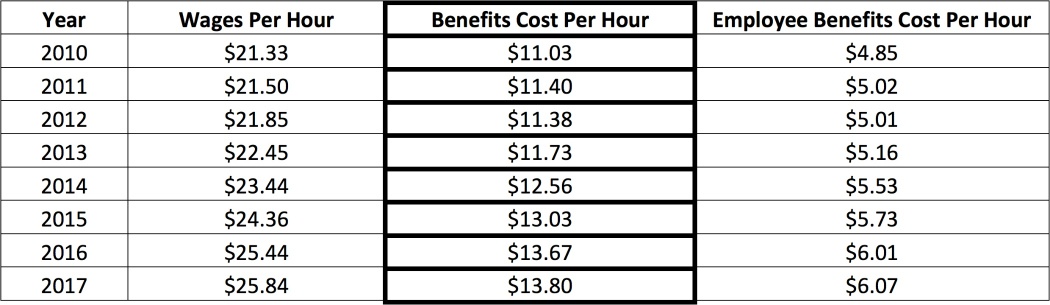

The average employer/employee cost share for a manufacturer in the Midwest is roughly 75/25. Breaking it down with data from The U.S. Bureau of Labor Statistics, the cost of wages per hour worked has grown by an average of $4.51 in the last eight years.

Further, the BLS reports the total benefits cost per hour worked — including both employer and employee contributions — has grown by an average of $2.77 since 2010.

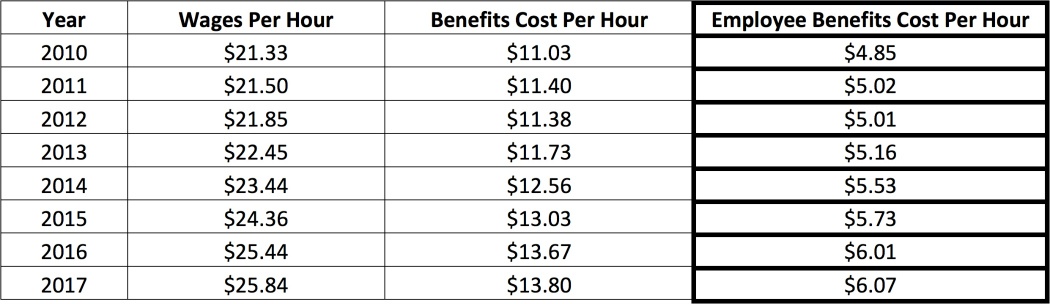

Let’s couple these government statistics with data from independent actuary and consultant, Milliman, for a closer look at how to be competitive in this space. The firm finds employees contribute to the cost of their benefits with an average of 27% of their wages in payroll deductions. Employers, Milliman says, contribute 56%. Using this data, the chart below shows the approximate benefits cost manufacturing employees pay per hour worked. Note that this does not include the additional 17% in out-of-pocket expenses employees are forking over.

While these numbers provide some benchmarking perspective, if you’re a manufacturer looking to ensure your benefits are competitive in order to ease the pain of having positions remain empty, you need to take a look at how well you’re managing your health care supply chain.

To fall in the high range of these manufacturing labor statistics and be among the most competitive employers, take a look at how you’re managing the 80% of annual plan costs that are variable. Milliman has studied how employers spend money under any form of benefit plan. What they found was, 20% of the plan cost is a fixed expense, such as plan administration fees or stop loss premiums. The other 80% is variable. It changes depending on what services your employees are getting, where those services are being performed, and what kind of claims you are amassing.

Of those variable expenses, 96% comes from four verticals in the health care supply chain:

Focusing on these four areas will have the greatest impact on plan costs. Lowering the overall cost of your benefits means you can become more competitive by paying a higher percentage of employee benefit costs. Or increase wages. Or both.

A Look at the Numbers – National versus Regional Costs – How Do You Stack Up? In the war for talent it is important to understand what hourly wages...

Employee benefits are a top-three line item for most companies, but many employers have given up on this category of expense. Accepting defeat, they...

Here’s a hard truth for most manufacturing firms. You’re not managing the supply chain when it comes to your employees’ benefits, which means you’re...